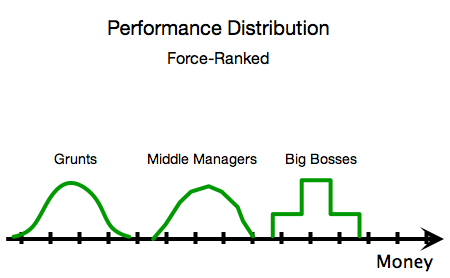

In theory, appraisals are the tools to get the choir to sing the perfect notes each time. They are the tools to effectively manage, organize, and deploy a corporation’s resources effectively to maximize shareholder’s value. Usually the feedbacks gathered for appraisal are used as input to forcibly place the person’s value to the company in a normal distribution curve. This way people are “encouraged” (read: incentivized) to do better than their peers. In other words, it creates an environment where everybody races to get to the top 10% of the normal curve.

In theory, appraisals are the tools to get the choir to sing the perfect notes each time. They are the tools to effectively manage, organize, and deploy a corporation’s resources effectively to maximize shareholder’s value. Usually the feedbacks gathered for appraisal are used as input to forcibly place the person’s value to the company in a normal distribution curve. This way people are “encouraged” (read: incentivized) to do better than their peers. In other words, it creates an environment where everybody races to get to the top 10% of the normal curve.

However, when the population size is small, appraisal by normalization (i.e. forced-ranking) can no longer work since the normal curve does not really exists anymore. Furthermore in a small population it is easier to get ahead of the “curve” by sabotaging your peers (By the way, if you want to use the normal distribution then the population size need to be at least 30 distinct individuals, at least that’s what I recall from my statistics class).

If you look at the illustration above, you’ll notice that the “Grunts” group has a smooth performance distribution curve whereas the “Big Bosses” has a jagged distribution group. Hence it follows that the “Middle Managers” group is somewhere in between. This is derived directly from the population size dictated by the hierarchical nature of corporations – the grunts comprises the bulk of the population whereas the big bosses is the elite group.

I have recently notice this happening myself. In the high-ranking managerial positions in which there are not many people available to draw the normal curve properly, the forced-ranking process actually hurts shareholder value.

A Real-Life Story

At a recent fire drill event, I met an ex-colleague of mine in which we both worked at the same company (both of us no longer work at that company). His employer at the time shares a building with mine. I asked him about our old organization, “How were things going over there?” He replied, “Really bad, man. [There were] bloodshed everywhere.” This was (still is?) a large bank which bought another large bank that went under due to the subprime mortgage crisis. Probably after a year down the road, they found that the purchase was not a good decision and then they start finding ways to remove people while minimizing the compensation they need to pay to do it. I am not sure whether this was the reason since I was not working there anymore when it happened.

After a few weeks, I got a phone call from an employment agent telling me that the bank was hiring. Interestingly around the same time, they were also interviewing a friend of mine. It looks like they were in a big hiring spree again. It is quite strange since they were removing people a few months ago, and then they started hiring after a short while. That’s quite expensive from an operational perspective since they hire big employment agencies that charges them 2-3 month’s salary of the hired person (the hiring company pays the fee, not the employee).

Then I remember what one of my ex-bosses at that company said when I work there. He said that the appraisal and subsequent normalization process is done on a per-grade basis. That means they grade Analysts against other Analysts of the entire company and Vice Presidents against other Vice Presidents. Everybody is ranked on the A, B, and C grades and the organization always get rid of the Cs if it does not change into a B after a semester. He was a Vice President at that time, which was two levels above me in the pecking order.

Now I see it. Therefore, by extension normalization is also done at the director level, against other directors. The last time I check there were four directors for the entire Singapore operation, both on the business and technology sides.

Then how are you going to do normalization on four people?

You simply cannot. You can try to rank them and you will always get one A, two people will get B grade and one will get C. In this environment, it is easier to sacrifice one of your colleagues to ensure that you can still keep your job – make one of them get a C grade and that will ensure you will get a B and you also get to keep the job.

Post-Mortem Analysis

It looks like this is what happening at that organization. Let us say that you are a Director of one Cost Center. That is, your department’s wages and other expenses doesn’t directly contribute to your company’s revenue. This is in contrast to a Profit Center department, which if you grow your department’s expenses, it will grow your company’s revenue as multiples of those expenses.

In order to make your department look more profitable, you reduce headcount while maintaining the same workload. There are two ways to reduce headcount: fire them or move them to other departments. However, if you move them, it will be more work for you since you need to find a new home for the guy that you’re throwing out. If you simply make them quit, your colleague’s department will need to pay that hefty agency fees to fill any additional positions that he/she needs. Therefore if you fire people instead of transferring them, it’ll reduce your own costs and troubles and also adds cost to your rival department if they really need the people that you’re throwing out.

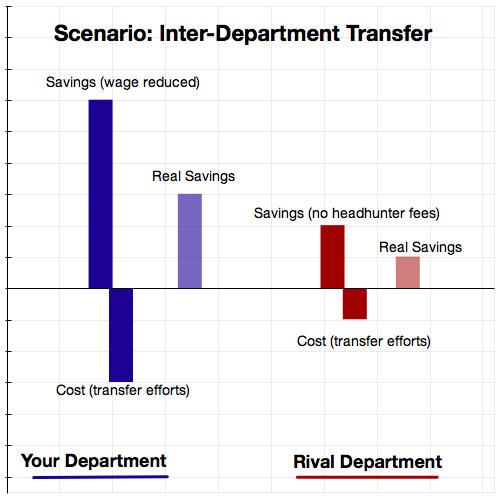

If you look at the chart below, the inter-department transfer scenario will have an OK-level of savings for both you and your rival’s department. That is if you move people that you don’t like to a department that needs them the most, it will involve effort in your part which negates the benefit that you have by reducing wages. In turn, your rival will have some cost savings since he doesn’t need to pay headhunter fees. All-in-all, this is good for the company, but the benefit for your own department is rather minimal.

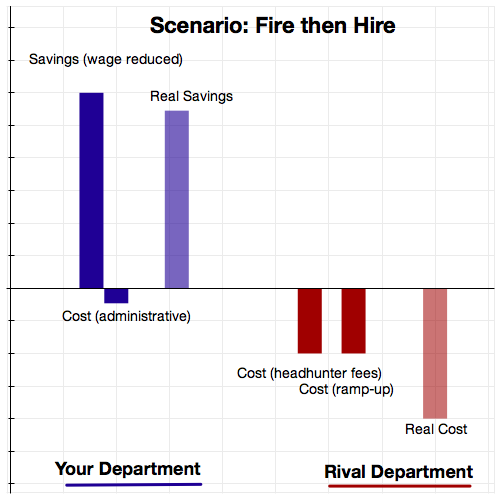

In contrast, the chart below shows the fire-then-hire scenario shows that your department gets a lot of real savings whereas your rival incurs huge costs. That is, if you simply remove people that you don’t like and just let your rival find their own people, it will benefit your own department as well as cripples your rival. Sure overall this isn’t good for the company but that’s your boss’ boss’ job to worry about, not yours.

From those two illustrations, you can see that by firing people you actually kill two birds with one stone (or is that two pigs with one bird? ^_^ ). That is you reduce your own department’s cost, making you look good, and you increase your rival department’s cost, making them look bad on force-ranked appraisals. Of course, the net effect is a cost for the organization, but this is not easily visible on the balance sheets and you as a Director can always find ways to justify your decision.

A Dilbert Spinoff?

This sounds like a high-ranking version of the Dilbert comic. Hey Scott Adams, probably the Pointy-Haired Boss now deserves his own comic strip? ^_^

That’s all for now folks. Take care and be safe.

0 thoughts on “Why Appraisals are Bad”